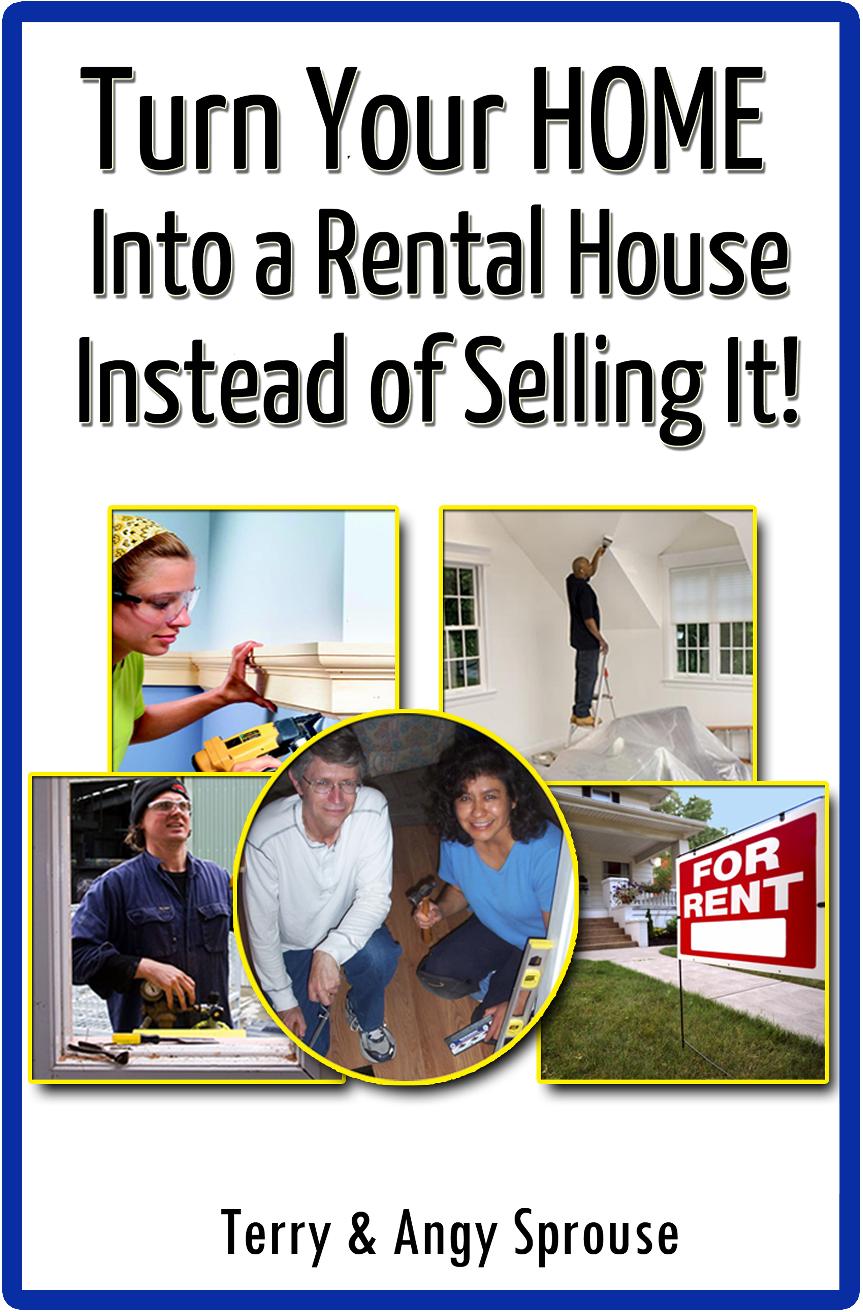

By Terry & Angy Sprouse

We (Terry & Angy) are partners in both marriage and in real estate business.

Who says married couples can’t be business partners? And the great thing is we have never considered divorce . . . murder sometimes, but never divorce. Well, never murder, really, but maybe forcing each other to watch, in an uninterrupted viewing, the horrifyingly bad movie, The Clan of the Cave Bear.

In reality, this business has been a bonding experience, not only for us, as husband and wife, but also for our two boys, who have been active participants in the business from the very beginning.

9/11 Attacks Take the Starch Out of Us

We started in real estate investing following the terrorist attacks on the World Trade Center. The ensuing economic recession forced our hand. The hours at Terry’s job were drastically reduced. We realized that for the security of our family, we needed to have a business on the side—a business able to provide regular cash flow in case Terry’s 9 to 5 job suddenly went away.

This led Terry to experience a very intensive period of soul searching and in-depth research (accompanied by gratuitous whining and moping). We decided that a rental house business was the best way to go. We were excited to find the rental business was an easy business to learn and to start. This business required no special license, degree, or training. And the results tempered the most important source of Terry’s whining. The rental business offered the potential to make money.

We Jump In and Hope the Net Appears

We essentially just jumped in with good intentions and very little practical knowledge. After we made up our minds that this is what we wanted to do, we simply bought an inexpensive fixer-upper house, one that had foreclosed and been repossessed by a bank. We moved into and lived in the fixer-upper house while we did the necessary repairs.

But most importantly, we did not sell our original home. We rented it out.

Angy Puts Her Foot Down – On Top of Terry’s Foot

It took a little adjustment to move into that first fixer-upper house. The first thing we did was to get one of the bathrooms back into working condition. Angy’s negotiating stance on that topic was, “I’m not living in that house unless at least one bathroom is fully operational!” At that, who could argue? Marveled by a mother’s logic, together Terry and the boys nodded their heads and dropped the labeled empty plastic bottles they held in their hand into the Recycle Box.

As we went forward with the repairs, we changed bedrooms frequently. Moving from room to room, we cleared out of one bedroom to install tile and then moved again out of the next to make room to install carpet. Huffing and puffing, we moved furniture from one side to the next as we worked through the house painting all the walls. We replaced the cabinets in the kitchen, the fixtures in the bath, the leaky plumbing and the outdated lighting.

Group Hugs

Preparing meals required serious creativity. Entertainment and rest required the same. But the support and flexibility from all family members, and a few timely “group hugs” (some through gritted teeth), got us through.

—–

Recommended reading:

Remove that Garbarge Disposal Now!

6 Steps to Roof Maintenance (for the Home that will Turn Into a Rental House)

How I Evicted A Problem Tenant in 4 Steps

When to Hire a House Inspector – Radio Interview with Rich Peterson

Getting Rid of Bad Tenants

“Turn your home into a rental” on Mark Wayne Show

7 Reasons to Live in a Fixer-Upper House While You Repair It

6 Steps to Roof Maintenance (for the Home that will Turn Into a Rental House)

Our First Rental House Plunge

10 Most Frequent Problems Found by House Inspectors

5 Steps to Get Your House Ready to Rent by Terry Sprouse

5 Steps to take if your house is flooded

Some perfectly legal ways to maximize your rental profits

Add “Start a Rental House Business” to Your Bucket List

The 5 Rules on How to Lose Money and Get Your Rental Property Trashed by Tenants

Window Repair with #2 Son

Required Roof Maintenance for Fixer Upper Houses

Learn to Repair Your Fixer Upper Houses

How I Got Started In Fixer-Upper Houses

How to learn to operate a fixer upper house business

The Peaceful Warrior and Fixer-Upper Houses

ey