“The greatest real estate fire sale in the history of the United States rages on.”

— CNBC

Foreclosed properties are selling like hotcakes. Now is a great time to get some great deals on investment properties Besides the price, below are four reasons why you can count on real estate to provide you with security today and in the future.

Cash flow

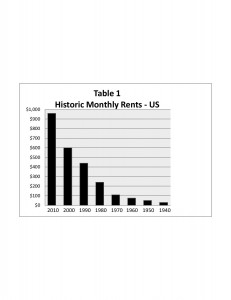

With a good rental property, after all the expenses have been covered, including mortgage, vacancy rate, repairs, and property management, you can still receive a good cash flow. This provides a reliable monthly income for as long as you want to keep the property. As the amount of rent that you charge goes up, your profits go up. See Table 1 (U.S. Census Bureau, 2012) for historic monthly rents in the U.S., from the U.S. Census Bureau.

Demand for Housing

There will be always be people in need of a place to live. With our growing population, a gain of one American born every 14 seconds, we will have a population of 400 million by 2050. Based on our current immigration patterns and population growth, there will continue to be a demand for housing well into the foreseeable future.

Appreciation

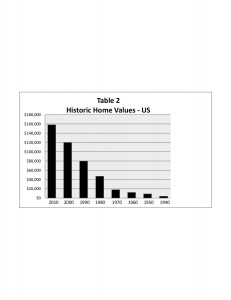

In the short term, housing appreciation seems to unpredictably rise and fall. However, in the long term, over a 60-year period, house values show a steady and consistent upward trend. According the U.S. Census Bureau, from 1940 to 2010, the average increase in the value of a house was about 5% per year, adjusted for inflation. Table 2 (U.S Census Bureau, 2012) shows historic home values.

While appreciation of 5% may seem low to some people, when we consider that we only put a small percentage down, between 5-20%, and we receive monthly rent checks that more than cover mortgage payments, it begins to make sense. If we don’t allow periodic dramatic rises and falls in home values to shake our confidence, we can count on steady, long-term, profits from our investment properties.

Tax savings

Our kindly Uncle Sam wisely gives tax incentives to real estate investors. The federal government allows you to depreciate your investment (or reduce your taxes to account for physical deterioration of the house) on Schedule E of your annual tax form. In addition, you deduct expenses related to your investment from your gross income on IRS Form 1040, and reduce the amount of income that you pay taxes on.